It has been almost three years since Finance Minister Mthuli Ncube introduced his much-hated 2% tax. It’s still not clear why the tax was introduced, so many reasons have been given, but it is now an accepted fact of our lives. Sometimes something outrageous concerning the tax happens however and people are forced to question the whole IMTT tax thing again. This past week such an incident involved Ecobank, account-holders received a shocking SMS from the bank concerning the 2% Tax:

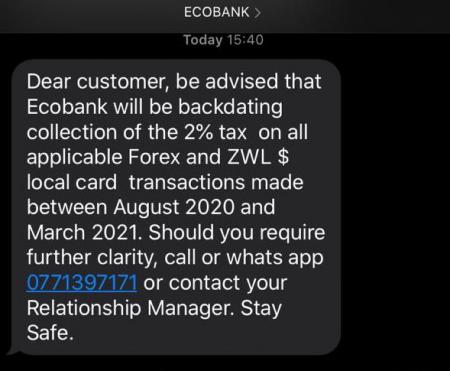

Dear customer, be advised that Ecobank will be backdating collection of the 2% tax on all applicable Forex and ZWL $ local card transactions made between August 2020 and March 2021. Should you require further clarity, call or whats app [sic] 07711397171 or contact your Relationshp Manager. Stay Safe

The conntents of the SMS

That had the bank’s customers in an uproar on social media. Many questioned why the bank had not been collecting the tax as usual and were fearful that once the back collection happened their entire salaries would be wiped away this month-end. Indeed it’s not clear what happened or why the bank was not collecting the tax as mandated by the authorities. Depending on how many transactions you made you can indeed end up losing a sizeable chunk of whatever comes into your account this coming month if the bank goes ahead and deducts the tax as promised.

What is astounding is that this is not the first time Zimbabweans have come head to head with such a fiasco. In November of last year, FBC account holders also got the shock of their lives when the bank said they would be backdating the collection of the IMT tax. In this case, however, the period covered was just a few months from August to October 2020. It’s worth mentioning that it wasn’t the bank’s fault as the government was trying to backdate the application of the law.

Similarly, Standard Chartered Bank in December last year announced that it too would be backdating the collection of the 2% Tax (over a period spanning from 1 November 2018 to 1 November 2020). In its initial announcement, Standard Chartered had not clearly laid out how the collection process would go. But after we reached out to the bank they said that the collection process would be done in payment plans that would bring the least inconvenience to its customers.

The Ecobank situation bears some resemblance to FBC’s but one has to ask why they weren’t collecting the 2% tax all this time. What happened with Standard Chartered and FBC must have been an example they surely didn’t want to emulate. Stranger still, is why we are seeing things like this when, as already said, the tax has been a factor in our lives since 2018.

You should also check out

Last week we had the opportunity to talk to former member of the Reserve Bank of Zimbabwe’s Monetary Policy Committee Eddie Cross to get an insider’s view on the state of the economy and policy. The conversation stretched from SI 127 of 2021 and if it still in effect for businesses that trade outside the forex auction, to the Forex Auction and cryptocurrency adoption in Zimbabwe.-techzim