Pay As You Earn (PAYE) is a system that is used to calculate how much from your gross earnings your employer is going to deduct to pay the Zimbabwe Revenue Authority (ZIMRA) Income Tax on your behalf.

The Income Tax Act [Chapter 23:06] specifies which parts of your salary as an employee are subject to the tax. An example is from what we saw in the Finance Act of 2021 No.7 which said that anyone who earns part of their salary in United Stated Dollars will have it all regarded as being US$.

The pertinent question is, what exactly makes up an employee’s gross earnings? The answer to this comes by way of ZIMRA which says:

“Assume then for a moment that everything you earn, be it in cash, benefits, or an item of value given instead of cash is subject to some form of tax. However, the determination of the value and its associated tax liability in respect of any of these forms of payments will differ in some cases.”

ZIMRA

So what ZIMRA is saying here is that on top of the money you earn every month, whatever benefits that you might get from your employer are subject to the PAYE calculation. This could be if your company provides lunch, transport allowance, pays for your internet, mobile data, airtime, accommodation etc.

All of these things need to be broken down into monetary terms plus whatever you are paid per month/week to result in your gross earnings. It is from that amount that your employer then calculates using the Pay As You Earn Tax Tables to determine how much the company has to deduct from your gross earnings to remit to ZIMRA as Income Tax. The reminder that an employee walks away with, is classified as your Net Earnings.

Pay As You Earn (PAYE) Income Tax Tables

Let’s use the 2022 ZWL$ tax table as an example with a hypothetical gross salary of ZWL$200,000.00 per month. The fact that our scenario says ZWL$200,000 per month means that we will skip through the table to the Monthly Table.

RTGS (ZWL$) PAYE 2022

| DAILY TABLE | |||||||

| Rates | |||||||

| from | – | to | 821.92 | multiply by | 0% | Deduct | – |

| from | 821.93 | to | 1,972.60 | multiply by | 20% | Deduct | 164.38 |

| from | 1,972.61 | to | 3,945.21 | multiply by | 25% | Deduct | 263.01 |

| from | 3,945.22 | to | 7,890.41 | multiply by | 30% | Deduct | 460.27 |

| from | 7,890.42 | to | 16,438.36 | multiply by | 35% | Deduct | 854.79 |

| from | 16,438.37 | and above | multiply by | 40% | Deduct | 1,676.71 | |

| WEEKLY TABLE | |||||||

| Rates | |||||||

| from | – | to | 5,769.23 | multiply by | 0% | Deduct | – |

| from | 5,769.24 | to | 13,846.15 | multiply by | 20% | Deduct | 1,153.85 |

| from | 13,846.16 | to | 27,692.31 | multiply by | 25% | Deduct | 1,846.15 |

| from | 27,692.32 | to | 55,384.62 | multiply by | 30% | Deduct | 3,230.77 |

| from | 55,384.63 | to | 115,384.62 | multiply by | 35% | Deduct | 6,000.00 |

| from | 115,384.63 | and above | multiply by | 40% | Deduct | 11,769.23 | |

| FORTNIGHTLY TABLE | |||||||

| Rates | |||||||

| from | – | to | 11,538.46 | multiply by | 0% | Deduct | – |

| from | 11,538.47 | to | 27,692.31 | multiply by | 20% | Deduct | 2,307.69 |

| from | 27,692.32 | to | 55,384.62 | multiply by | 25% | Deduct | 3,692.31 |

| from | 55,384.63 | to | 110,769.23 | multiply by | 30% | Deduct | 6,461.54 |

| from | 110,769.24 | to | 230,769.23 | multiply by | 35% | Deduct | 12,000.00 |

| from | 230,769.24 | and above | multiply by | 40% | Deduct | 23,538.46 | |

| MONTHLY TABLE | |||||||

| Rates | |||||||

| from | – | to | 25,000.00 | multiply by | 0% | – | |

| from | 25,000.01 | to | 60,000.00 | multiply by | 20% | Deduct | 5,000.00 |

| from | 60,000.01 | to | 120,000.00 | multiply by | 25% | Deduct | 8,000.00 |

| from | 120,000.01 | to | 240,000.00 | multiply by | 30% | Deduct | 14,000.00 |

| from | 240,000.01 | to | 500,000.00 | multiply by | 35% | Deduct | 26,000.00 |

| from | 500,000.01 | and above | multiply by | 40% | Deduct | 51,000.00 | |

| ANNUAL TABLE | |||||||

| Rates | |||||||

| from | 0 | to | 300,000.00 | multiply by | 0% | Deduct | – |

| from | 300,001 | to | 720,000.00 | multiply by | 20% | Deduct | 60,000 |

| from | 720,001 | to | 1,440,000.00 | multiply by | 25% | Deduct | 96,000 |

| from | 1,440,001 | to | 2,880,000.00 | multiply by | 30% | Deduct | 168,000 |

| from | 2,880,001 | to | 6,000,000.00 | multiply by | 35% | Deduct | 312,000 |

| from | 6,000,001 and above | multiply by | 40% | Deduct | 612,000 |

Aids Levy is 3% of the Individuals’ Tax payable

According to the Monthly Pay As You Earn Tax Table, that individual makes in the 30% range (ZWL$120,000.01 to ZWL$ 240,000.00). This means to get their Net Salary/Earnings we will need to multiply their gross salary by 30% and subtract ZWL$14,000 from the result

- ZWL$200,000 x 0.3 = ZWL$60,000

- ZWL$60,000 – ZWL$14,000 = ZWL$46,000

The ZWL$46,000 a month is the Income Tax that the employer will deduct from the employees Gross Salary to pay ZIMRA. This means that the employees Net Income is ZWL$154,000.

3% AIDS Levy

Additionally, there is a 3% AIDS Levy that qualifying individuals will need to pay. This was instituted in 1999 and entails a 3% income tax for individuals and a 3% tax on profits of employers and trusts (with the exclusion of the mining industry until 2015).

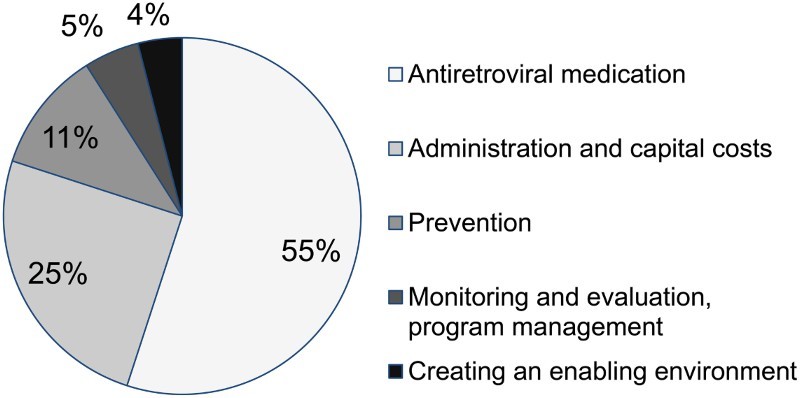

The AIDS Levy is, in principle, used to acquire medications and means for the prevention of the disease. Over 55% of the amount raised is meant to acquire antiretroviral medication.

The AIDS Levy is calculated after deductions have been made from whatever tax credits the company or individual qualifies for. An example of this is the Youth Employment Tax Incentive which awards up to ZWL$180,000 per year to companies as a tax credit for employing individuals under 30.-Techzim